The crypto industry continues to evolve at lightning speed. As we move deeper into the digital economy, 2026 is shaping up to be a crucial year for innovation in blockchain and digital assets.

Whether you’re an investor, tech enthusiast, or business owner, understanding the latest Cryptocurrency Trends can help you stay ahead of the curve.

In this article, we’ll explore the top 5 cryptocurrency trends in 2026 that are expected to reshape the future of finance.

Before diving into this article, don’t miss our previous blog on How Blockchain Works in Cryptocurrency. Understanding the foundation of blockchain technology will help you make smarter decisions in the world of digital finance.

Why Cryptocurrency Trends Matter in 2026?

Cryptocurrency is no longer just about trading Bitcoin. Today, it influences finance, technology, gaming, healthcare, and global payments. Keeping an eye on emerging crypto developments allows individuals and businesses to make smarter decisions and reduce risks in a fast-changing market.

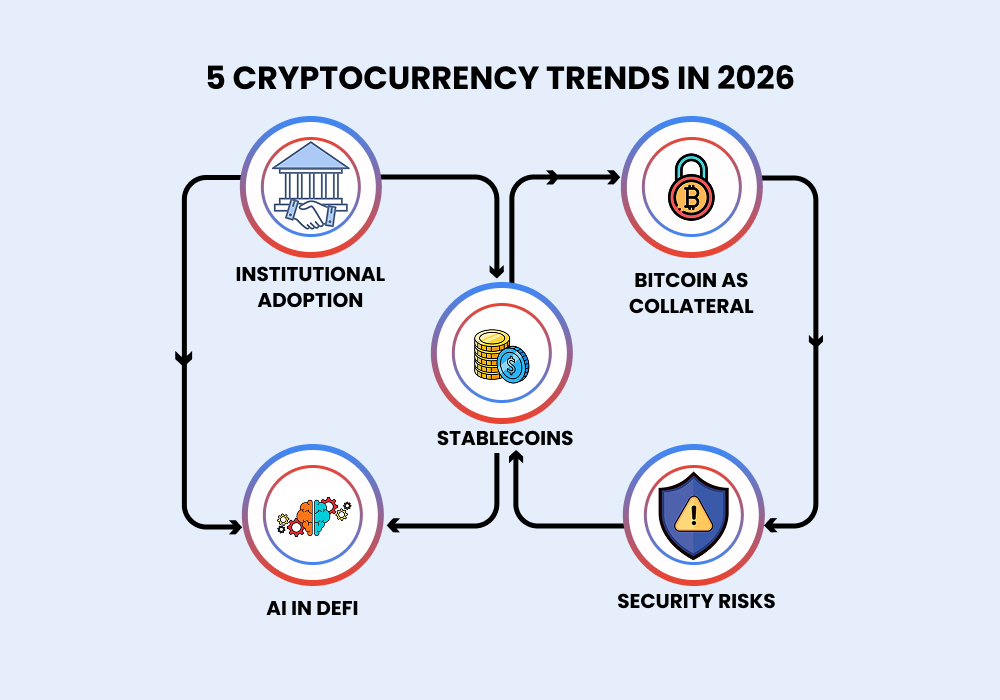

Top 5 Cryptocurrency Trends in 2026

The digital currency landscape is evolving at lightning speed, and staying ahead of the curve has never been more critical. As we navigate through 2026, several cryptocurrency trends are reshaping how we think about money, investments, and blockchain technology. Let’s explore the five most significant cryptocurrency trends that are defining 2026.

1. Mainstream Adoption of Central Bank Digital Currencies (CBDCs)

Governments worldwide are embracing digital currencies. In 2026, Central Bank Digital Currencies (CBDCs) are expected to see wider adoption.

Unlike traditional cryptocurrencies, CBDCs are regulated and backed by governments, offering greater stability and trust. Countries are using them to improve payment systems, reduce fraud, and promote financial inclusion.

This shift is one of the most important Cryptocurrency Trends to watch, especially for businesses involved in cross-border payments.

2. Growth of Real-World Asset Tokenization

Tokenization is transforming how people invest. In 2026, real-world assets like real estate, stocks, gold, and art are increasingly being converted into digital tokens on blockchain networks.

This trend allows:

- Fractional ownership

- Faster transactions

- Improved transparency

As a result, everyday investors can access high-value assets with smaller budgets. This innovation is redefining digital finance and strengthening the role of blockchain in traditional markets.

3. AI and Blockchain Integration

Artificial Intelligence (AI) and blockchain are becoming powerful allies. One of the fastest-growing Cryptocurrency Trends is the integration of AI into crypto platforms.

AI is being used to:

- Detect fraud

- Improve trading algorithms

- Enhance security

- Optimize smart contracts

By combining automation with decentralized technology, crypto platforms in 2026 are becoming smarter, safer, and more efficient than ever before.

4. Expansion of Decentralized Finance (DeFi 2.0)

DeFi is evolving beyond its early limitations. In 2026, DeFi 2.0 focuses on better security, scalability, and real-world usability.

New platforms are addressing past issues like high gas fees, hacks, and liquidity problems. With improved protocols, decentralized lending, borrowing, and staking are becoming safer options for long-term users.

This evolution plays a major role in modern Cryptocurrency Trends and continues to challenge traditional banking systems.

5. Sustainable and Green Crypto Solutions

Environmental concerns are pushing the crypto industry toward greener solutions. Energy-efficient blockchains and eco-friendly consensus mechanisms like Proof of Stake (PoS) are becoming standard.

Crypto projects in 2026 are prioritizing:

- Lower energy consumption

- Carbon neutrality

- Sustainable mining practices

This shift not only improves public perception but also attracts environmentally conscious investors and institutions.

Frequently Asked Questions

Q: Are cryptocurrency investments safe in 2026?

While crypto markets have become more stable with institutional adoption, all investments carry risk. Diversification and thorough research remain essential strategies for any investor.

Q: How do CBDCs differ from traditional cryptocurrencies?

CBDCs are issued and controlled by central banks, whereas traditional cryptocurrencies like Bitcoin operate on decentralized networks without government control.

Q: What is asset tokenization, and why does it matter?

Asset tokenization converts physical or traditional assets into digital tokens on a blockchain, enabling fractional ownership and easier trading of previously illiquid assets.

Q: Do I need technical knowledge to invest in crypto in 2026?

Not necessarily. User-friendly platforms and improved educational resources have made crypto investing more accessible, though a basic understanding of blockchain technology is always beneficial.

Q: How is the crypto industry addressing environmental concerns?

Through energy-efficient consensus mechanisms like proof-of-stake, renewable energy-powered mining operations, and carbon offset programs integrated into blockchain protocols.

Final Thoughts

The crypto landscape in 2026 is more mature, regulated, and innovative than ever before. From AI-powered platforms to sustainable blockchain solutions, these Cryptocurrency Trends highlight how digital assets are becoming deeply embedded in everyday life.

Staying informed about these developments can help you make smarter investment decisions and prepare for the future of digital finance.